CHINA’S auto sales rose 5.7 percent to 2.71 million vehicles in September from a year ago as momentum continued amid rising demand and strong economic growth.

In the first nine months of the year, auto sales added 4.5 percent to 20.22 million units, according to data from the China Association of Automobile Manufacturers.

The sales growth momentum in September continued from August whose sales expanded 5.3 percent. Analysts predicted that sales will further grow steadily till the end of this year amid rising demand from consumers lured by promotions by manufacturers and dealers amid a strong domestic macro-economic environment.

“There are several reasons to further drive the growth of the China auto market in the second half of this year, such as strong economic growth and increased income of urban and rural residents,” said Xu Haidong, a spokesman of the association.

Earlier this year, the association predicted that China’s auto sales are likely to rise 5 percent this year, a slowdown from 13.7 percent last year, citing reasons such as the reduction of a tax incentive for small-engine vehicles.

In September, passenger car sales rose 3.3 percent to 2.34 million units while those of commercial vehicles surged 23.9 percent to 367,000 units. Commercial vehicles expanded faster in September compared with a 12.81 percent growth in August.

Sales of sport-utility vehicles rose 10.5 percent in September from a year earlier to 971,000 units. Sedan sales added 3.7 percent to 1.16 million units. Multipurpose vehicle sales dropped 25.1 percent to 166,000 units.

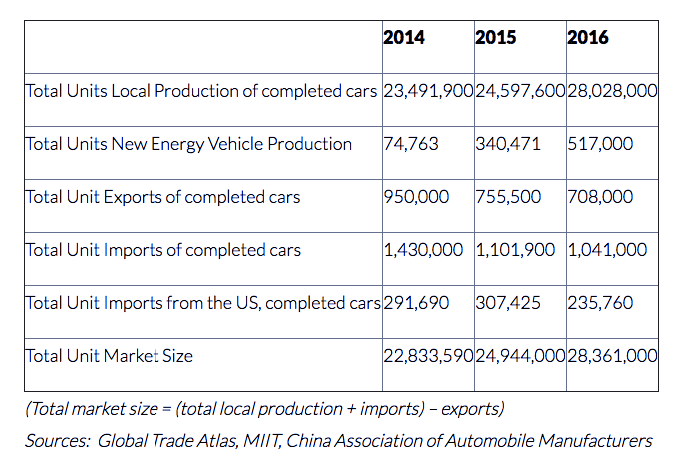

Sales of new-energy vehicles jumped 79.1 percent to about 78,000 units in September, faster than a 76.3 percent surge in August. In the first nine months of this year, sales of new-energy vehicles soared 37.7 percent to 398,000 units.

Electric vehiclesales surged 83.4 percent to 64,000 units in September from a year ago. Sales of plug-in hybrids rose 61.9 percent from a year ago to 14,000 units last month.

source credit; shanghaidaily